Welcome to The Investor Handbook

Your go-to blog for successful investing

Who We Are

Hi, we’re Anthony and Marie.

Together we hope to be able to provide you with quality content that can help you see money in a different light and become a better investor.

Our Mission

Financial literacy is a powerful thing, which too few really have. Our mission is about sharing the knowledge we wish someone would have told our younger selves.

What We Do

- Posts on financial education

- Mini-guides on investing

- Reviews of the best book on investing

- Instagram channel on financial education

- Financial coaching

Our 6 objectives

01.

Mindset change

Working 9 to 5 every day for the rest of your life shouldn’t be an acceptable concept. We’re here to showcase the power of investing so that you too can enjoy financial freedom.

02.

Financial literacy

There are risks to investing, but a little financial literacy goes a long way. We’ll equip you with the knowledge to ensure Wall Street never rips you off.

03.

Investing

The financial world has an inherent interest in making you believe that investing is complicated. It isn’t. We’re here to show you how to start investing.

04.

Stock market

The stock market is probably the best way to grow your money and generate passive income. Unfortunately the stock market isn’t well understood and people compare it to gambling. We’ll show you how investing in stocks can be safe, sustainable, and rewarding.

05.

Optimization

The stock market tends to go up over the long term, so making money from stocks isn’t particularly difficult. However optimizing performance is a skill most investors lack. Let us show you how.

06.

Financial freedom

With an ever increasing retirement age, government debt, and uncertain future, financial freedom is more important than ever before. Ready to get started?

What prompted this blog

As young adults, we were always told to get a job, save 10% of our salary, and retire in our 60s. You can imagine our astonishment when we discovered the concept of financial independence!

The idea of retiring early seemed crazy to us. We thought it was also one of these things reserved for the top 1% of earners. Luckily for us, we were wrong and every year thousands of average people are able to retire in their 30s and 40s.

These people live the dream: they have enough passive income to fire their boss, quit their day-job, and pursue their passion. Some people quit their city-job and move closer to home to focus on their family. Others quit their boring job to work in a field that makes them happy or fulfilled such as working for GreenPeace or starting an animal shelter. Others use the extra income to take the occasional sabbatical year and travel the world, go on a meditation retreat, or just to take time-off and enjoy the healthy years of their lives.

The discovery that financial independence was possible has changed us forever.

Luckily there are hundreds of blogs out there documenting their journey to financial independence and providing invaluable tips on how to save money. These blogs focus on everything from personal finance, credit cards, savings accounts, debt, insurance, starting a business, or investing in real estate. There’s even a blog focusing exclusively on dividends!

Most of these blogs also have a section on the stock market which provides a detailed picture of the basics of investing. Most of them will tell you to buy index funds and wait, which is pretty good advice! As young investors eager to avoid the high-fees charged by our banks, we were eager to start investing on our own. We scoured through countless personal finance blogs and reputable media sources like the Financial Times or the Wall Street Journal to find the best way to invest.

Unfortunately, we couldn’t find anything worthwhile. We only found futile (but entertaining) stock market commentary and the occasional generic advice on index funds. We were left wondering, how do I build an investment portfolio? Is the stock market too high? Which stocks should I buy? Will the stock market go up? How much should I invest? Is now a good time to invest? How much diversification is enough?

And that’s why we started this blog. We figured that if no blog was providing a comprehensive handbook on the stock market, we’ll build one! And that’s how The Investor Handbook was born. We also launched a second website dedicated exclusively to investing advice for expats.

About me

After spending the better part of my youth trying to get the best grades possible, applying to the coolest internships, and working as hard as I can to get promoted, I had finally saved a good bit of money, which then prompted the question: Now what?

I had spent most of my time at work either working hard, or being the embodiment of presenteeism by pretending to work longer hours while really I was doodling my finances on an excel sheet. I then spent the rest of my time either studying for interviews or trying to network, all in the hope of getting promoted or landing that new job that would pay me a higher salary.

As the grinding wheel of work was getting mundane, I started asking myself: Surely there has to be a better way? So I took it upon myself to read numerous personal finance books. It was the insights of these books that helped me realize: If I spend hundreds of hours at work to make money, I might as well spend a little bit of this time to learn how to manage money. This is where everything clicked.

And the snowball started rolling. I googled how to invest, started reading personal finance blogs, ordered dozens of books on investments, and started investing in the market by buying stocks, index funds, and ETFs. I now built a winning portfolio that works for me (more on that below!)

My financial goals

I have been saving money since I was 16, invested in some banking products since the age of 19, but only started investing on my own at the age of 26 (looking back, I wish I started sooner, way sooner.).

My goal is to reach financial independence (also known as financial freedom in America). I quantify financial independence as a sustainable source of income of 2000 euro per month. Now this won’t help me live like royalty, but I consider that 2000 euros would let me enjoy a comfortable life, especially if I move abroad and live in a cheaper location (e.g. Thailand, Argentina, Turkey). Most importantly, this stable passive income will help me feel financial secure and ensure that I never have to work a boring job if I don’t want to.

What does 2000 euro look like in perspective? Here is the minimum and median net salary in different countries in 2021*.

*all salaries are net of tax and have been converted to euros comparability purposes. Changes in foreign exchange may skew these figures.

As you may notice, passive income of 2000 euro is higher than the median salary in France, Spain, Poland, China, or Turkey. It’s also pretty close to the median wage in “expensive” developed countries such as Australia, Canada, or Germany.

In other words, the sacrifices you make today (by saving and investing) means that you will one day derive as much passive income as the average person makes after working full-time in the developed world. I don’t know about you but this blows my mind.

To me, having a lot of money is not the goal. My goal is to be wealthy in a sustainable manner which will grant me the freedom to live my life how I want to.

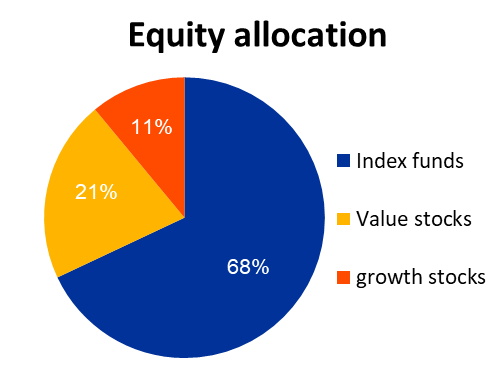

How do I achieve that? I invest in the stock market, primarily through low cost index funds but also the occasional stock when I identify a great buy. I hold stocks and ETFs for the long term and do not panic when the market falls (on the contrary I rejoice as I am able to buy stocks at a discount!). I will probably hold on to my portfolio forever and only sell when following the 4% rule.

Financial independence is not about retiring, it’s about the freedom to do what I want. If I want to quit my job and surf in Costa Rica for a year, I can do that. In truth many people can, but don’t as they fear it may impact their job prospects. Taking time-off work, whether it be for a meditation retreat in Tibet, humanitarian work in South America, or simply time-off to raise children, has professional (and thus financial) drawbacks. Financial independence frees you from this burden.

You do not need to achieve financial independence before venturing out into the world to follow your dreams. It is okay to take a year off (or two) as long as you accounted for it in your financial plan. I placed 24,000 euro in bonds precisely for that purpose. Bonds are low-performing but stable investments, thus I know that the 20,000 euros will be there when I need it. Placing that cash into bonds means that I can take my first mini-retirement next year no matter what, even if the stock market has just crashed or if I lost my job, the money will always be there. I am currently thinking of skiing in Canada, surfing in Costa Rica, hiking in Peru, attending a boxing school in Argentina, and perhaps make my way to Hawaii for a vacation before heading to Japan for the food. Not only can I afford to do that before financial independence, but because my money will remain invested throughout my mini retirement, my investments will continue to grow even when i’m not working!

Remember: Saving money isn’t the goal. Money is simply a means to an end.

My Portfolio

Growth - oriented

A legit portfolio

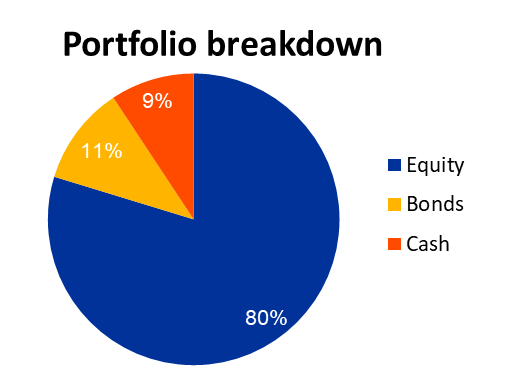

My portfolio is aligned to my financial goal: To reach financial independence as soon as possible. This dictates: (i) an aggressive stock allocation for superior long-term gains; (ii) a year of expenses in the form of bonds for a comfy financial cushion and; (iii) optimizing performance through low fee ETFs, strategic asset allocation, and value averaging.

01

Long term vision

Stocks outperform all other asset class over the long term. That’s why I invest heavily in stocks and intend to hold on to my portfolio forever. Once I reach financial freedom, I will only sell according to the 4% rule to ensure I never run out of money!

02

Low risk

My bonds provide a great financial cushion while my index funds provide exposures to over 6400 stocks. Now that’s diversification!

03

Performance

My portfolio aims for higher performance through strategic asset allocation and a disciplined approach to value averaging & rebalancing.

A quick explanation

I am not claiming that this is the best portfolio composition possible, but it is one that works for me! As an investor with years of earning potential ahead of me, and with no plans to spend this money anytime soon, I can afford to dedicate a large chunk of my portfolio to stocks over bonds or cash. This may not be the case for you. Have a read through my new & advanced investors page to find out more.

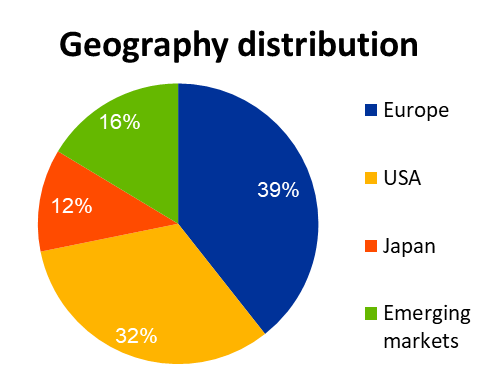

You may have noticed that my portfolio has a lower allocation to US stocks than expected. This is due to my asset allocation and value averaging strategy: History tells us that, over the long term, the returns of the US, European, or Japanese stock market are very similar. With this knowledge, we can confidently apply our value averaging strategy and buy into the stock markets which are cheap (e.g. Europe) while pouring less cash into stock markets which are expensive (e.g. USA).

This means that my asset allocation is now dynamic and is a by-product of the market’s performance. For example, if the US stock market was to crash soon, I would be buying into the S&P 500 in bulk, which may increase my allocation to US stocks. The important thing is that I am investing according to time-tested and proven strategies instead of blindly following the herd.

41,121 €

Total gains as of December 2021