Investment basics

All the fundamentals you need to invest well

Disclaimer: As financial jargon has deterred many would-be investors for years (myself included), this investing guide has been drafted with the simplest language possible.

Table of Contents

1 - What is investing?

Investing money is simple. You choose not to spend your cash and you place it in a savings account. Your bank will then pay you interests on these savings. The same goes with investing in debt (e.g. bonds) or the stock market (companies), you invest a little bit of money now and you will get more later.

2 - Is investing risky?

Knowledge - Some people have never researched how to invests but they believe they can. In this case our over-confident investor would take his potato, throw it on the ground and expect it grow. As our would-be investor never learned that you should dig a hole and plant the potato, the potato simply rots in the sun and dies. Our investor gets upset because of the investment loss (the potato), concludes that investing is too risky, and never invests again. The same goes with the stock market, throwing money at an investment without any purpose does not work (unless you get lucky).

Research - Suppose our investor is back, this time with the knowledge that you should plant the potato first. The investor plants the potato in the garden, waits a few months, and comes back to check on his investment. This time around the potato has disappeared and there are no new potatoes in sight, the investment didn't work, what went wrong? Well our investor forgot to do any research, turns out that potatoes do not grow at all times of the year and in all climates. While the logic was correct (planting vegetables works) it was the wrong vegetable! Our investor once again gets upset and swears to never invest again. The same goes with the stock market, you can't simply buy one stock at a random time and expect it to grow. How do you get around that? You simply plant all sorts of vegetables, some of them are bound to work (there is an easy way to do that in the stock market, they're called index funds and they're great, read more on section 6).

Greed - This time our investor won't be fooled. He planted all sorts of vegetables and is excited about the plentiful harvest. However our investor gets greedy (after all, the last two investments were a failure and he's keen to make up his losses with this new technique) and harvest the vegetables prematurely. The result? Not only are the vegetables much smaller than expected but they're not ripe yet! Our investor once again lost his initial investment. The same goes with the stock market, you can do everything right, but if you do not give it time to grow, you will not make any money.

Investing isn't difficult, in fact its easier than farming as it can be done at any time of the year, within the comfort of our own homes, and can be done in just a few minutes each year.

In similar fashion, avoid checking your investments every day, the same way you wouldn't check on your potatoes every day. Short-term fluctuations will only serve to excite you or demotivate you. Keep a long term view and you will reap great returns.

3 - When to start - Savings

Strive to save up at least two months worth of living expenses. Store that cash in a savings account and use it only in cases of emergency. This will ensure that you will never be in a desperate need for cash and will never need to sell your investments to afford basic necessities. In personal finance this is known as an Emergency Fund.

How big should your emergency fund be? Well it should be sufficient to cover for basic necessities and any unforeseen expenses (e.g. pay for a car or home repair). As a rule of thumb strive for at least two months of living expenses and increase it if you expect any big expenses in the future. Once your emergency fund is set-up, you may start investing with confidence.

(PS: I personally only have two months of living expenses stashed away in a savings account but I keep about 6 months of living expenses in the forms of bonds (more about bonds below!)).4 - Where to invest

Let me explain why, compared to other asset classes (e.g. real estate, gold, bonds, or savings account), equities are a performing asset, which means that behind every company share you buy, there are real employees servicing real customers who pay with real money. The profits then go to the real company shareholders (you!). Historically, the stock market has averaged 9.1% yearly return, now this beats your European savings account at 0.1%!

Here are historical returns of different asset classes: Commodities (e.g. Gold) – 2.3% Bonds – 5.3% Real estate – 7.2% Stocks – 9.1%

Now I know what you’re thinking: Why should I risk investing in the stock market while real estate has produced an average return of 7.2% and bonds provided 5.3%? This is much better than my puny savings account. On top of that bonds are supposed to be safer and real estate is a real tangible asset - that makes it safe, my parents and grandparents chose real estate too!

To visualize the difference, here's how the performance would compare over the next 40 years (assuming the historical performance remains stable):

Not only does the stock market offer better returns over the long term, it also has the following advantages over real estate and bonds:

Here are 4 reasons why the stock market is a better investment than real estate:

Diversification & risk – You can buy the entire stock market via an index fund ETF (explanations below) and guarantee your fair share of stock market gains. You can’t do that with individual apartment, hence buying real estate is akin to gambling on an individual stock;

Fees - Do not forget that real estate implies hidden fees such as agency and notary fees, not to mention estate transfer tax that some countries have. In Germany for example, the fees can add up to 12% on top of the buying price;

Convenience & liquidity – Buying real estate is extremely time consuming, it is risky as all your money is in the same apartment, and selling your apartment at a profit may take a long time. With stocks, you can do it online in less than 2 minutes.

Performance –Stocks have outperformed real estate by an average of 1.9% and that’s significant over the long term (see the chart above)!

Two warnings on bonds:

Performance – Bonds offer horrible returns. Even when bonds' returns are calculated on their historical performance of 5.3%, inflation erodes most of the gains. Consider European bonds: when adjusted for inflation they provided a mere 1.2% average yearly over the last 100 years! The situation is even worse today with negative interest rates.

False sense of security - Bonds are often viewed as safer than stocks because of the law: When a company declares bankruptcy, the company's assets (e.g. offices) are sold and the money is used to pay off any loans, bonds, and shareholders, in that order. (Yes you will likely lose a lot of money if you hold shares in a company which is going bankrupt, but bondholders may lose out too. If you're taking the risks, you might as well boost your performance with stocks, especially with today's low interest rates)

To learn more on when bonds can be useful, read our dedicated mini-guide.

5 - How to invest

(i) Cheap online brokers, which increase simplicity and drastically reduce investing costs;

(ii) Low-cost index funds, which allow us to invest in hundreds of stocks in one transaction and ensure great market returns over the long term;

(iii) Low interest rates, which boosts stock market performance.

Investing in stocks has never been easier! We simply need to open an account at an online broker, transfer some money, search for an ETF (or copy/paste an ISIN code) and click buy! In comparison our parents & grandparents had to physically travel to a bank brokerage firm, fill-out paperwork, wait a few weeks for approval, call up a broker, wait for a broker to pick-up the phone, pay exorbitant transaction fees, and invest in individual stocks or pricey mutual funds based on what the broker would tell them. Investing wasn't simple before the internet, it is no wonder our elders rarely invested.

Our generation has been blessed with advancements in technology and financial ingenuity, let's take advantage of it. here is how you can double your money in 7 to 8 years:

Open an account at a cheap online broker (e.g. Degiro, Interactive Brokers, or Tradestation Global)

Buy an index fund ETF replicating the world’s stock market or the USA’s S&P 500 index (e.g. ISIN code: LU1781541179 or IE00BFMXXD54)

Wait 7.5 years*

Indeed, while the stock market has average an annual performance of 9%, bear in mind that this is only an average. the journey to reach the 9% average has been volatile, as illustrated in the table below.

Historical performance of the MSCI world index

| YEAR | RETURNS |

|---|---|

| 2020 | -4.49% |

| 2019 | 27.67% |

| 2018 | -8.71% |

| 2017 | 22.40% |

| 2016 | 7.51% |

| 2015 | -0.87% |

| 2014 | 4.94% |

| 2013 | 26.68% |

| 2012 | 15.83% |

| 2011 | -5.54% |

| 2010 | 11.79% |

| 2009 | 29.99% |

| 2008 | -40.71% |

| 2007 | 9.04% |

| 2006 | 20.07% |

Look at 2020 for example, we experienced the fastest stock market crash in history because of Covid-19 where the market lost 34% in February / March. By September 2020, global stocks had completely caught up and were up almost 4% from the start of the year.

Yes the market will go up and down like a yoyo, but if you stay invested for the long term, especially on index funds, you have nothing to worry about.

6 - Understanding Index Funds

What is an index fund?

For example, the index MSCI world index holds shares in 1600 companies around the world, in essence it replicates the performance of the world's stock market. The MSCI world index is probably the simplest way to invest in stocks, you can own most of the world's stocks in just a few clicks!

There are other index funds available, for example the S&P 500, the commonly used benchmark for the U.S stock market, consist of shares of 500 U.S companies such as Amazon, Google, Apple, Microsoft, or Facebook.

What is the difference between an index fund and an ETF?

An ETF can be built around just about anything but are frequently replicating a stock market index (e.g. MSCI world or the S&P 500), or sectoral indexes (e.g. technology or healthcare).

ETFs allow you to buy index funds directly through a broker (just like any other stocks). Alternatively, also open accounts at investment companies (e.g. Vanguard or Fidelity) and skip ETFs all together by investing in their index funds directly.

Four reasons why index funds are great

Consistency – Index funds are passively managed (i.e. they do not frequently buy and sell stocks hoping to beat the market). Index funds simply buy a stock and hold it forever. This helps them save on trading fees and minimise capital gain tax over the long term. Ponder on the following investment motto: time in the market is better than timing the market. Most Index Funds would also tend to reinvest dividends automatically, meaning that you’ll never miss out on any stock market gain and get to benefit from compound interest (see below).

Performance - Index funds are constantly pushing all time highs. Through this simple product you can own nearly every single company in the world's stock market, meaning you won’t miss out on any future winners. Remember when IBM was considered the most valuable tech company? It is now eclipsed by Google, Amazon, Facebook, and Apple. Chasing the hottest stock does not work, and missing out on future winners will not lead to riches, so what do you do then? You simply buy the whole market through an index fund.

Safety - Holding individual stocks carry significant risk. Sometimes a blunder by the CEO can crash the company, other times a company might fail to diversify and its products may become obsolete (e.g. video cassettes), you are then likely to lose a significant amount of money. Even if you do your research and the company looks great, an accounting scandal can rock a company and plunge it into bankruptcy (remember Wirecard?). Bottom line: there is a degree of risks with individual stocks. These risks are significantly reduced with index funds. An index funds allow you to become a shareholder in each company within the index, and unless everything single company fails (and what are the odds of that?), you will never lose all of your investments.

Not only are index funds safer and less volatile than individual stocks, but they also perform better. Holding an index fund for decades will guarantee you your fair share of stock market return by making sure you own all the hottest stocks, never miss out on sudden stock market gains by staying invested, and experience the magic of compound interest.

7 - Understanding compound interests

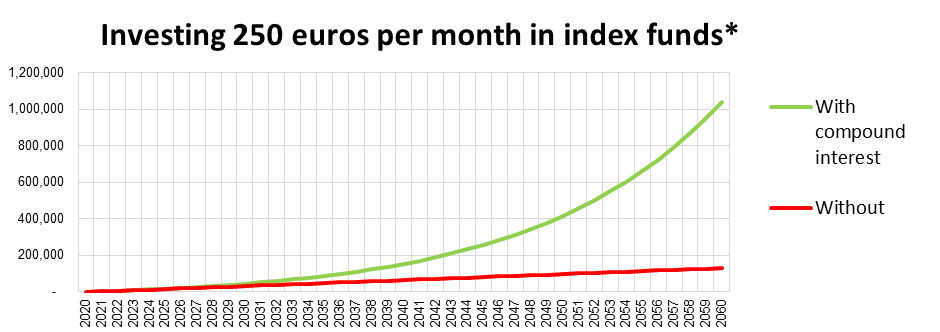

Are you ready for this? This chart will change your life. I was flabbergasted the first time I discovered the magic of compound interest and I remain surprised at the amount of investors who still haven’t discovered it. Albert Einstein himself called compound interest as the eighth wonder of the world.

Yes you’re seeing clearly, investing just 250 euros per month would make you a millionaire in 40 years! In other words, compound interest has allowed your total investment of 120,000 euros (250 euros monthly over 40 years) to grow to over 1 million euros. Now you understand why Albert Einstein called compound interest the eighth wonder of the world!

How can you use compound interest? Well if you invest in index funds, you do not have the do anything, the index fund will grow over the years and will reinvests the dividends automatically. If you chose to invest in individual companies, you would simply need to reinvests each dividend you receive.

(This is another reason why index funds are great: Low fees & compound interest. Index funds extremely cheap with some annual expense going as low as 0.02% of total capital. In comparison, an average actively managed investment fund offered by your local bank may charge you as much as 4%! Remember the magic of compound interest? Well, excessive fees by banks and investment managers will lead you down the curse of compound fees.)

8 - Stay invested and don't panic

We've been aware of Covid-19 for months, we all saw Wuhan under lockdown and the spread of the virus in Europe, yet the stock market kept climbing higher, for some reasons investors weren't spooked yet. Then a few cautious people starting selling stocks in anticipation of an economic downturn, this pushed share prices down but the market saw it as a healthy correction (after all, the market was already up 16% over the last 5 months, it had to stop somewhere) but nobody panicked yet. Then quarantine and confinement measures were announced and people started panicking. Not only were people hoarding toilet papers, but they started selling their stocks too. As everybody rushed to sell their stocks at any price possible, the world stock market dropped accordingly. The sell-off lasted 31 days.

What happened since? The market fully recovered by August and by September it was once again pushing all-time-highs. What happened to the sellers? They panicked and sold their stocks at a discount, now they have to buy them back at full price. The exact same thing happened for each financial crash. Bottom line: Stay invested and do not worry about short-term fluctuations, the stock market likes to climb, it always has.

Think of this way: Let's say you reached financial freedom and decided to open up a restaurant in the Bahamas. You rent a property, hire some staff, and sell great food on the beach, your business is a huge success and the customers keep on coming. One day, a hurricane is announced, and worse-still, you can see the clouds from your window, what do you do? Do you panic and run around looking to sell your restaurant with a steep discount? Probably not. You hunker down and wait for the storm to pass. The same goes with the stock market.

SUMMARY

As soon as possible! Ideally as soon as you built an emergency fund to cover at least two months of living expenses.

Remember, with compound interests, time is on your side so the earlier the start the richer you will get.

Open an account at a cheap online broker, buy low-cost index funds, and hold on to them foreever. If you already have hundreds of thousands to invest, you can skip brokers and open an account directly at index funds issues such as Vanguard or Fidelity.

Remember: try to avoid traditional banks and anyone who called/emailed you about an investment products, they are likely looking for an easy commission and do not have your financial interests at heart.

Buy ETFs that track index funds. They have performed better than mutual funds and the average stock-picker.

Index funds ensure that you own a share of every single company within the index, this means that you will never miss out on the next Microsoft or Facebook. In addition the index fund will automatically reinvests your dividends and will systematically adjust to changing parameters. If one company grows, this will be reflected in the index funds directly. Index funds are low maintenance and can be held for decades without the need to check on them even once.

Index funds are also much safer than individual stocks. Ensuring you own every single company means that you will never lose all of your investments (as you can with individual stocks) and they will be less volatile too, so you get the added peace of mind in addition to the superior performance.

Greed, ignorance, boredom and a little bit of fun.

People can be overconfident, and some believe they can beat the market average. They follow high-growth companies like Amazon or Tesla, sometimes it works and they get rich quick, other times they lose half their money, as some did with Bitcoin.

Some people are perfectly content buying and selling stocks according to their local investment guru. They may not have even heard of index funds and simply buy stocks according to how they feel. For them it’s more a game akin to gambling rather than a long-term investment strategy

Index funds are simple and efficient, but for some people it becomes difficult to believe how something so simple can bring such strong results. As a result they start to doubt the strategy, arguing that it’s just the current hype and can’t possibly last. So they revert to buying stocks hoping to find the next big thing.

Fun also plays a big part too. Some people (myself included) enjoy looking at companies’ fundamentals and experience great thrills when we find a great company at a good price. Others are dividend investors and take joy in receiving dividends every months. Rockerfeller was famously quoted with: ” Do you know the only thing that brings me pleasure? It’s to see my dividends coming in.”

Others are bored and may start day-trading hoping to make additional money. For most day trading is underwhelming and they quit, for others they succeed and it becomes their full-time job. Here is the catch: It becomes a job, not an investment. So yes they can make money, but so can any of us if we work all day. Day traders do not make money in their sleep, we do.

Population growth, technology, and compound interests. When company make profits, they tend to reinvests it in the business. This fuels growth and leads to even more earning next year. The process is repeated year after year and companies grow. Company that make profits stay in the business and the market grows accordingly. The companies who fail drop-off the index and are forgotten. As such holding an index funds means that you hold a large collection of profitable enterprises which should continue growing (as earnings are reinvested). Even if economic growth starts to slow and local consumers are not able to buy new products, companies can always sell their products abroad.

Technology also plays a role, the rise in automation has increased efficiency and businesses have been able to produce more for the same or lower costs. This has increased both productivity and competition, both of which are great for economic growth and the stock market.

Lastly, even if no economic growth is achieved at the world level, and no technological or managerial improvements occurred, your investments should continue to increase! Why? Because the index fund would have automatically reinvested the dividends!