I have been talking to a few investor friends recently and they all have one thing in common: they’re always encouraging others to invest. And there are good reasons for that, investing has changed their lives for the better and they want to spread this source of sustainable wealth to everyone.

But this got me thinking: with the huge amount of investing information out there, and with investors in each corner of the world preaching to others why they should invest, why are there still plenty of people who aren’t investing?

The first thing that comes to mind is: some people just can’t afford to invest. This appears to be a perfectly logical conclusion. After all, if you’re struggling to pay rent, how can you find money to buy stocks? However there’s an entire reddit thread where thousands share their experience of achieving financial independence on a super tight budget. So this isn’t it.

So if financial success isn’t linked to income, it must be linked to a money mindset.

If you’re on the fence about investing and not really sure what the fuss is about, this post is for you.

Ready to have your mind blown?

Here are 5 revelations about money that will make you rethink the way you look at your finances forever. Time to rethink the value of money

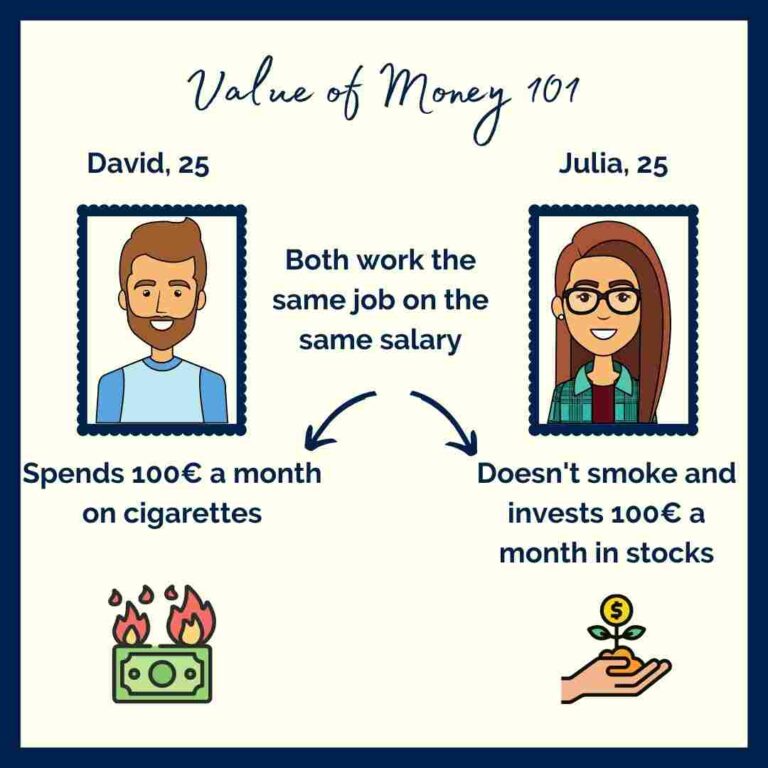

1. Small expenses matter more than you think

People tend to ponder on expensive financial decisions such as buying a house, car, or even a TV. But when it comes to paying for a coffee, cocktail, or taxi? We tend to splurge without thinking.

Sure, a coffee here and there may seem like a negligible amount that will have no impact on your future. But unfortunately, it actually does.

Here’s an example to illustrate:

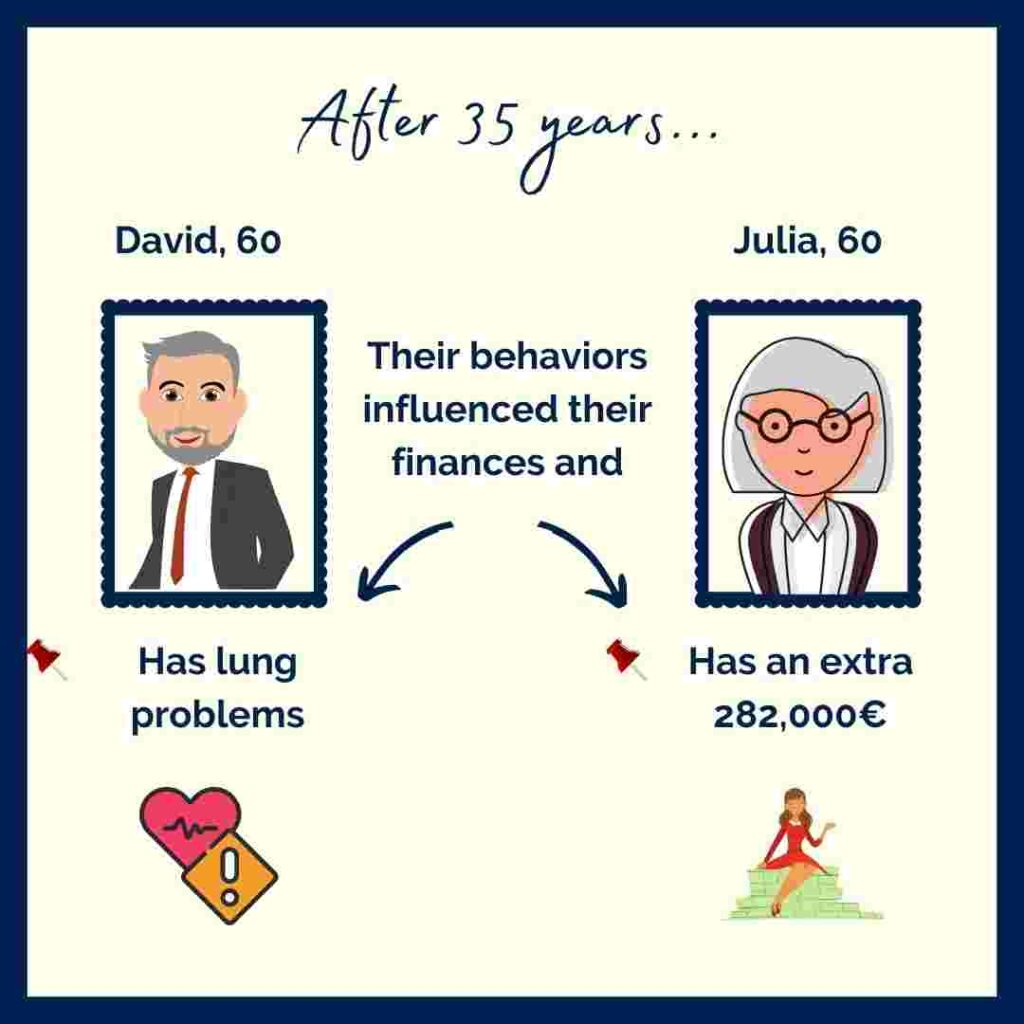

100€ may not seem like a big expense over a whole month but here’s the thing: It accumulates over time.

Combine the power of cumulative efforts with the wonder of compound interest from the stock market and you have a perfect recipe for building wealth! That’s how you turn “cigarette money” into a vacation house.

What's the real value of an Iphone?

Now here comes the mic-drop moment (at least for me):The latest Iphone is priced at 1099$ in the USA. The alternative to buying the new Iphone is to invest this money. Assuming the market’s average annual performance of 9% continues, this will amount to:

2,601$ in 10 years

6,159$ in 20 years

14,581$ in 30 years

In other words, is that new Iphone really worth 14,581$ to you in the future?

Understanding the concept of opportunity cost (AKA the real value of your spending) is the first step towards better money management. By putting a future price tag on the things you’re considering spending money on now, you suddenly have a different perspective to the real value of your money.

Now that you know the real value of your money, you can allocate it to the parts of your life you cherish most.

2. Do you really think you can't save?

Too many of us think that we’re not earning enough to save, let’s debunk that myth.

The concept of Financial Independence and Retiring Early (FIRE) is relatively new but it still has been around long enough for people to play around with it. A fascinating variation of it is called “lean FIRE” (aka financial independence on a budget).

There’s an entire reddit thread focusing precisely on that subject and each day hundreds of young investors share their story of retiring early on a budget. My favorite story is of a single dad who retired with about 1000$ in monthly passive income. If that guy can raise a kid with a 1000$ and live a happy life, surely you can survive alone on that income.

Sure, you’ll probably have to eat out less, avoid the Starbucks coffee, downsize your house, and cut your spending as much as you can, but the point is: It is possible!

Let me dwell on this one for a second: the point of this example is to show you that our lifestyles are a choice. We can change them at any time.

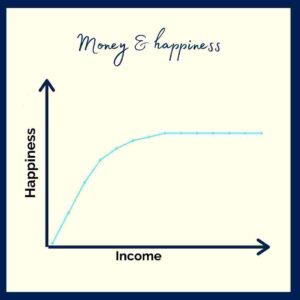

If you’re worried that spending less will leave you unhappy, don’t be! Studies found that we don’t need much to be happy. US researchers surveyed happiness levels and found that extra income only mattered up to a point: an annual income of 50,000$. After that, each salary increase incrementally brings in less happiness up to a salary of 75,000$, at which point increases in income were no longer linked to increased happiness.

Moral of the story:

So if spending more money won’t make you happier in the long run, so why not invest it? Your future-self will thank you a thousand times if you can retire 20 years early.

3. You're much richer than you think

When I told some friends I quantified financial freedom as 2000€ in monthly passive income, I got some weird reactions. My favorite was:

“2000€ per month? Rent is already at 1400€!“

This was an understandable reaction, we live in Frankfurt (Germany) where rich bankers are pushing rents up, but here’s the thing: his rent wasn’t average.

My friend chose to live in a pricey apartment, in a pricey part of town, which is itself in a pricey city. My friend’s spending habits were far from average.

To put that into perspective, here is the net median wage per country*:

* Median salary implies that 50% of the population is earning less than the median wage while 50% is earning more.

The graph above illustrates the minimum and median net salary across different countries. As you may see, 2000€ per month is far from average. It is much higher than the median wage in Poland, Portugal, China, and Turkey. All of these places have decent standards of living where the average person lives a happy life. It is also more than twice the minimum wage in Japan, which is one of the most developed countries on earth.

You know how you tend to shop around for the best deals on a new computer, fridge, or car? Well, you can do the same with your country of residence once you reach financial independence. Shop around for the best deal, you may even be able to find someplace that is cheaper and sunnier!

4. Money is life energy

This concept is put forward by Vicki Robins in her book Your Money Or Your Life. It’s a great book and I’ll simplify the idea in a sentence: If your hourly wage is 10€ an hour, then 10€ is worth an hour of your time.

In other words:

- a 3€ coffee is equal to 18 minutes of work

- a 50€ dinner is worth 5 hours of your life

- a 1099€ iphone costs you 13.7 days of work

Sounds bad? Well it only gets worst: The real cost of a materialistic lifestyle is actually much higher than you think.

Think of it this way: There are 24 hours in a day, when you work 8 hours a day, do you really have 16 hours of free time? Probably not. Your job is actually taking a lot more of your time when you account for other time-consuming factors such as the:

- time to get ready in the morning

- commuting time

- occasional unpaid overtime

- Time spent networking at useless company parties

- Hours spent filling out lengthy job application form and studying for interviews

- And of course the time spent "recovering" from work by crashing on your couch instead of living life.

If you factor in all of these work-related “time expenses”, you’ll realize that you’re really sacrificing a lot more than 8 hours a day. In fact this can turn your 8 hour workday into a 11 hour workday, effectively reducing your “real” hourly wage from 10€ an hour to 7.2€.

Tired for working for money? Invest it and have your money work for you! Keep investing long enough and one day you’ll never have to work again.

If you’re interested in calculating how much your job is really taking away from you, the book has a free life energy calculator here.

5. Money is a state of mind

I know this sounds cliché but it’s too true to leave out: money is all about your state of mind.

Ultimately, everything depends on your point of reference: An 8-year old with 100€ is super rich. In comparison a 30-year old with 100€ is pretty broke. Here’s a memorable example:

The richest man in history

Consider the example of Marcus Crassus, a Roman general, politician, and close ally of Julius Caesar. Crassus was so rich that he is often considered the richest man in history. He could have enjoyed a retirement like no other, but he didn’t.

Despite being the richest man in history, Crassus wasn’t satisfied with what he accomplished and wanted more. At the age of 61, he raised an army and invaded Persia. Crassus was defeated, ambushed, and killed shortly after.

Moral of the story: You can be the richest man in history and still want more.

Here’s another example: Bernie Madoff. Madoff is the infamous fraudster who ran the biggest Ponzi scheme in history. You’d think he dwindled people out of their hard earned cash for financial gains but here’s the thing: Madoff was already super rich before starting his Ponzi scheme. He was the founder and CEO of one of the largest firms on Wall Street and was already a member of America’s 1%. He did not need the money by any stretch, he was just driven by greed.

The stories of Crassus and Madoff are perfect examples of how financial security is a state of mind, not a number.

What does that mean for us?

As the examples above have showed us, the hardest thing to do in personal finance is to get the goal post to stop moving.

It may seem natural to chase that high-paying internship when you’re a student, chase that promotion in your late 20s, chase that dream car in your 40s, and chase that beach house in your 50s. But if you’re always chasing after new expenses, you’ll always be pressed for money.

In other words: You need to get your financial goals to stop moving.

If you’re struggling to save money, in most cases the solution isn’t to increase your salary, it’s to raise your humility. Ultimately savings is the gap between your income and your ego.

I know that this is probably the hardest thing to do. But as shown in point #3, you’re probably already richer than you think.

Conclusion

I’ll leave you with one final thought: Money is freedom

Instead of working for money, why not have money work for you? All you need to do is invest and you’ll start earning money in your sleep. Keep investing long enough and one day you’ll have enough passive income to quit working forever.

Reaching that point is known as financial freedom.

In other words: each time you invest, you’re buying a day off from work in the future. So the next time you find yourself in a materialistic behavior (because it happens to all of us) ask yourself, would you rather spend your money on an overpriced accessory/brunch/cocktail or invest it towards your financial freedom?

Thank you for reading & happy investing!