Why you should invest in the stock market

Investing isn’t just about making money, it’s about having the means to follow your passion, retire early, or protect yourself and your loved ones.

Investing is better than a job, it’s sustainable. If you quit your job today, you won’t have an income tomorrow. But if you stop touching your investments, they will continue to bring you money. Investing lets you earn money in your sleep.

Today we’ll look at why you should start investing as soon as possible, why you should invest in the stock market, and why you shouldn’t worry about the markets’ ups and downs.

Table of Contents

Why you should invest in general

Reason #1 - Freedom from money

Humans are increasingly becoming money driven but it’s not our fault.

Decades of media and marketing campaigns has fostered a strong culture of consumerism. As a result, we have been conditioned to associate success with money. We are increasingly favoring high-income careers over opting to be accomplished scientists or fulfilled family members.

As brilliantly explained by Vicki Robins in her bestseller book Your Money or Your life, we needlessly chase more money to the detriment of our happiness. We move away from our loved ones to move into a tiny overpriced apartment in a large city solely for money. We spend weeks of our lives networking with people we don’t like so that, maybe, it will help us get a promotion. We spend our birthdays at home preparing for interviews and miss important family events because “the flight tickets were too expensive“. Our decisions are guided by money.

It does not have to be this way. Investing allows us to grow our wealth to a point where we no longer have to sacrifice our happiness for money. This point is called financial independence. We can then quit the daily grind of working 5 days a week for 2 days of weekend freedom and focus on what makes us happy.

Did you neglect your own happiness to focus on a high-income career? Reaching financial independence give you the freedom to quit your job and follow your dream job, whether that be working for an animal shelter, joining the police force, becoming a teacher or a youtuber.

Reason #2 - Freedom to follow your dream

Reaching financial independence gives you the freedom to do what you want to do. Creating a long-term investment plan and sticking to it means you’ll no longer have to worry about earning money, your investments will do that for you.

Financial independence is essentially retirement, except you decide when you retire.

That’s why it’s also called Financial Freedom: it grant you the freedom to live where you want to, work the job you want, and retire at the time of your choosing.

Money may not buy you happiness, but it can get rid of all the money-related stress in your life.

Reason #3 - Financial security

Investing protects you against potential shocks, whether that is your losing your job, high inflation, or shaky government retirement plans.

With growing governments debts and an aging population, government pensions are not guaranteed, at least not in the same setting that they are today. Chances are we won’t enjoy the same level comfort from government pension that our elders currently enjoy. The retirement age keeps getting pushed back, and the benefits are not keeping up with inflation.

Even Germany, which is one of the most financially well managed governments in the world, has pushed the retirement age to 67, and are discussing pushing it to 69. If they’re talking about pushing it to 69 today, can you imagine how it’s going to be in 30 years?

I certainly don’t intend to retire at 67, yet alone 65 (Canada) or 62 (France). This is why I save as much money as I can and invest it every month.

Why invest in the stock market

There are a number of things you can invest in, but one is significantly better than others.

Commodities – You can choose to buy commodities (e.g. gold, silver, copper) and hope to be able to sell it at a profit later. The issue is that buying rocks is a losing strategy. The raw materials are not doing anything for you, they’re simply sitting there. Sure, maybe they help protect you against inflation, but that’s pretty much it.

Bonds – You can choose to lend money to a company or country and they will pay you interests. Many people choose to invest in bonds because of the perception that bonds are safer. The truth is, investing in bonds is a losing strategy over the long term. Perhaps this will help exemplify this: Over the last century, after adjusting for inflation the average annual return of European government bonds was a mere 1.2%. With today’s low interest rate environment, you’re even worse off.

Real estate – You can buy a piece of land today and hope to be able to sell it at a higher price later. While real estate seems like a good idea, it isn’t. When adjusting for inflation, agency fees, and taxes, real returns are dismal. In his book, Irrational Exuberance, nobel prize winner Robert Shiller found that real home prices in the United States have increased by 48% between 1809 and 2014. This is 0.3% per year, rethink real estate.

Business (stocks) – You can buy shares in established companies and have real employees work for you. You don’t have to launch your own start-up to be a business owner, you can simply buy stocks. While not each stock will give you the same return, as a whole, the world’s stock markets has average annual returns of 8% over the last century.

Which is a better investment? Since everyone has different taste and risk tolerance, let’s leave opinions at the door and focus on the cold hard facts.

Stock market performance

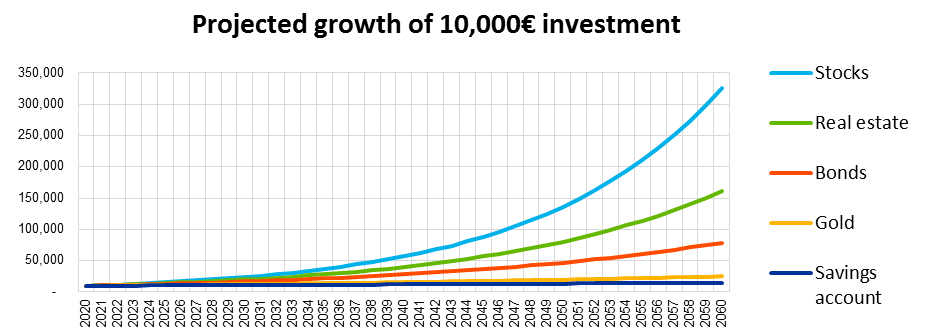

As you can see, an initial investment of 10,000€ in the stock market will grow to 325,829€ over the next 40 years (essentially multiplying your investment by 32!).

In comparison, real estate will grow to only 161,358€, that’s less than half of the stock market’s returns! And that is not even real returns, if we account for the 12% of fees & taxes linked to a real estate purchase, your investment will shrink down to 141,995€. Bonds come in 3rd place and amount to 78,911€ over 40 years.

Investing is a long term game. Don’t forget that your investment horizon does not end when you retire, it ends at the end of your life. Think of it this way: if you retire at 45 and life expectancy is 82, you still got 37 years of investing left!

The stock market always goes up

Another great reason to invest in the stock market is that it has always gone up over the long term. Investing is a winner’s game. let’s illustrate this with the chart of the S&P 500, a collection of the top 506 stocks in the USA. The next time someone tells you that investing in the stock market is risky show them the chart below and ask: Where is the drop?

Source: Google.com

Why does the stock market always go up?

There’s a multitude of reasons why the market goes up, here’s a top 8:

1. Population – the world’s population is continually increasing. In additions, millions are lifted out of poverty every year. As a result, the number of consumers is continually increasing. More consumers means more sales, thus more corporate earnings, and thus more profit for shareholders (you!).

2. Inflation – products are getting slightly more expensive every year, and this translates in slightly higher corporate revenues, and thus profits.

3. Productivity – Advancements in technology and management technique means we are now able to produce more than ever before and at a cheaper cost. This translates into higher corporate earnings margins.

4. Salaries – With increase in population comes increased competition in the job market. This drives real (inflation adjusted) wages down and corporate expenses along with it.

5. Reinvested profits – The majority of businesses are profitable and they tend to re-inject the profits back into the business to buy better equipment, hire additional staff, or develop new products. This leads to higher sales (and thus profits) next year.

6. Compounded growth – Businesses are able to repeat reason #5 every single year and that growth will snowball over time.

7. Dividends – If companies are not re-investing their profits into their business, they tend to pay them out to shareholders in the form of dividends. This is where shareholders can take advantage of compound interest and re-invest their dividends too. This means that as long as a business is making a profit, its share price is either growing or the shareholder is getting richer through dividends, either way the shareholder (you) benefits!

8. Money supply – This one is commonly overlooked. Since 1973, we have effectively abandoned the gold standard and governments now have the ability to print as much money as we need. Since them, each time we encountered an economic issue, we printed money and threw money at the problem until it went away. Here’s the thing: The money has to go somewhere. Eventually that stimulus is used to purchase a product and the cash transitions to the manufacturer and into the company’s treasuries, thus growing the company’s profits even more.

Other advantages to investing in stock market

So we figured out why you need to start investing, why the stock market is the best investment, and why it will always go up over time. Let’s now look at other practicalities.

1. It’s easy – Investing in the stock market has never been easier. Simply open an account at the broker of your choosing, select an ETF that tracks a broad stock market index (preferably one that reinvests dividends) and click buy! You can’t do that with real estate.

2. Low maintenance – Buying into a broad stock market index through an index fund is not only easy but also requires no maintenance. The index fund will hold all of the stock within a stock market index (e.g. the US S&P 500) and will automatically adjust itself to ensure that it always adequately reflects the stock market composition. Some index funds also reinvest your dividends automatically. With this strategy, your investment is on autopilot!

3. Diversification – it’s easy to diversify your investment portfolio with stocks, simply buy into different business who operate in different sectors and geographies. Alternatively, invest in index funds and you’re covered!

Debunking stock market myths

Some people never start investing in the stock market for a number of reason. Let’s debunk a few of them.

Myth #1 – The stock market is for the rich – Absolutely not. In fact with improvements in technology, the internet makes it cheaper (and easier) than ever before to invest in the stock market. The rise of low-cost online brokerage firms is a great example.

Myth #2 – The stock market is risky – that depends on your definition of risk. Can I guarantee that you won’t lose money in the stock market in the short term? Unfortunately not. But will it protect you from inflation better than a savings account? Absolutely. Does that make the stock market safer than a savings account? that depends on your definition of risk.

In fact I would make a counter statement: When it comes to long term financial security, not investing is riskier than investing. Historically, savings account and bonds provided horrible returns, and this is accentuated in today’s low interest rate environment. Don’t place your hopes and dreams on shaky government retirement plans, do you really want to keep working until the age of 67 (or more)?

Myth #3 – The stock market is gambling – For a day trader yes. But not for a long term investor. Yes, the stock market has its moods and it goes up and down for no apparent reason. But this only matters in the short term. Ponder on this example: at the start of World War 1, the S&P 500 plunged. At the start of World War 2, the S&P 500 gained over 9% in a single day. Where is the logic here?

The market is irrational in the short term. It’s futile to try to explain why the market went up or down today.

However, the stock market is remarkably accurate over the long term: it is able to continuously track corporate earnings. If corporate earnings continue to increase over time (which it should for the reasons listed above, the stock market should also grow by a corresponding amount over the long term

In short: Ignore the stock market’s short term volatility and take comfort in the knowledge that it should go up over the long term.

Myth #4 – The market is too high – This is a common misconception, one which I often believed myself. I sometime found myself struggling to buy stocks as the market was at all time high. I asked myself: what if I buy too high and the price drops tomorrow? This is short-term thinking. The market always goes up over the long term.

Yes the market may seem high today, it may even be 10% or 20% overvalued, but does that really matter over the long term? If you’re young you’ll probably be holding to stocks for the next 50 years, and what are the odds that the market won’t make up that 10% or 20% over that time?

A word of caution

As you may have noticed, this mini-guide focuses on investing in the stock market as a whole, not on individual stocks. Investing in the stock market is a winner’s game. The stock market tends to go up over the long term but not every stock will increase in value.

Here’s a few caveats to remember:

1. Potential loss – You can lose all your initial investment if you invest in the wrong stocks. Bankruptcies are rare but they do happen (to avoid this, buy into index funds instead, it will ensure you are never wiped out by a stock market crash).

2. Don’t try to time the market – Investing in the stock market via index funds is not enough, you must also hold them for the long term. Yes the stock market has always gone up, but it also experienced depressed periods lasting a few years. Don’t sell your index funds just because the market isn’t performing as expected and remind yourself that, over the long term, you can expect around 9% yearly return.

3. Beware of exotic products – Complex financial products are akin to curved TVs: they’re expensive, don’t improve anything, and are offered to you solely to make you feel as if your current set-up is inadequate. Make no mistake, you will one day come across an actively managed fund promising you higher return based on their new active gamma strategy (or whatever complicated jargon they come up with). When that happens, disregard the hype and remember that investment products with high fees will probably under-perform the market over the long term.

All of the caveats above are significantly mitigated by favoring index funds over individual stocks. This is why every stock market investor should allocate a sizable chunk (if not all) of their portfolio to index funds. Not only should they increase in value over time, but because you will be owning hundreds of stocks at once, it will ensure that you are never wiped out by a stock market crash.

Summary

Investing is a must for your financial security. Refusing to invest is akin to placing all your hope on government pensions and working until the age of 69 (or more). This means forfeiting your dreams of following your passion, retiring early, or taking the occasional year-long vacation.

High income earners who are great savers may be able to reach financial independence without investing, but for the rest of us, investing in the stock market is a must.

Remember: Nobody has ever saved their way to wealth. Investing is a simple yet effective way to earn money in your sleep.

If you’d like to read more, check out our mini guides on why the stock market isn’t as risky as you think and how to start investing, step by step.

FAQ

You can buy stocks (and ETFs) directly on a stock exchange. To do so, simply open a brokerage account at the broker of your choosing, select the stock / ETF /index fund you want to buy, select the amount, and click buy.

Your broker will then pass this order along to the stock exchanges and register shares in your name.

Terrible idea. Trading is not investing, it’s gambling. Traders can enact all of the stop loss orders they want, and make counter-order to hedge themselves, but at the end of the day, if there’s a sudden news, they may lose money. Trading is gambling.

Sure some day traders are able to make some money, but the truth is, they’re spending all day working towards it. Day traders are simply replacing their current job with a new trading job. In the end, they’ll actually make more money if they get a normal job like the rest of us and invest for the long term via index funds.

Day traders trade excessively and this increases their transaction costs (reducing their total earnings at the same time) Day traders also tend to close their position at the end of every day, meaning that they may miss out on any sudden upward market swing.