Investing is something we should all do. Investing allows us to grow wealth consistently and make us sustainably wealthy. This added financial security gives us the peace of mind to quite our day job and follow our dreams.

Investing isn’t difficult. Understanding money is as simple as understanding plants. You do not need to detail the chemical process of photosynthesis, you simply need to know that plants tend to do well when exposed to sunlight and water.

Unfortunately this knowledge tends to comes to you only after some trial and error. To help you avoid some headaches I experienced in the last few years, I have compiled a list of the top 10 things I knew before I started investing:

1. The stock market isn't risky

Yes, I’m sure you’ve heard of someone who lost a ton of money playing with stocks, but that’s because they were probably doing it wrong. Take a look at this table below.

Time period | Probability of gain* |

Day | 55 % |

Month | 62 % |

Year | 74 % |

4 years | 91 % |

*US stock market between 1926 and 1989. Source: Value Averaging by Michael E. Edleson (ISBN: 978-0-470-04977-8)

The table above highlights the probability of stock market gains if you invested in the US stock market at any given point between 1926 and 1989.

As you may notice, the probability of making money on a given day is just about 55%, which is almost the same as flipping a coin. But something interesting happens over longer periods:

The longer you stay invested, the lower the risk of loss. Historically speaking, if you stay invested in the US stock market for at least 4 years, your probability of making money is 91%. I don’t know about you but I like those odds!

Don’t forget that the time period studied was also heavily turbulent: The stock market experienced the great depression (where stocks dropped by 80%), World War 2, the cold war, and the black Monday of 1987. Yet despite these incredible turbulences, the market kept going up over the long term.

The next time you feel that the stock market is risky, come back to this page and have a look at this table.

2. Bonds & savings account won't make you rich

I remember the days where I was scouring through the internet to find the best savings account available. While it’s important to optimize interests on your savings account, you’re barking at the wrong tree.

You see, over the long term, the stock market will account for over 90% of your total investment gains.

Even bonds are barely worth it today. Sure, they’re a bit safer than stocks, but with today’s negative interest rates, you’ll be lucky to beat inflation.

There’s only 24 hours in a day, forget about that extra 0.4% you can make by switching banks and focus on optimizing your stock market gains instead.

3. Your banker isn't your adviser

Banks work hard to convince us that they’re a place of trust. Your banker has probably looked you straight in the eyes, gave you a firm handshake, and offered to give you some free financial advice.

But here’s the catch: They’re not giving you financial advice, they’re giving you a sales pitch.

Your banker isn’t your financial adviser, he’s a salesman.

A real financial adviser would probably propose investment products from other banks or brokers, and they’ll teach you how to invest on your own to save on fees. Your banker isn’t likely to do that. Instead they’ll point you to the bank’s most expensive service, or to a product on which they receive commissions.

Bottom line: if you want top performance, ditch your banker, get educated, and invest on your own.

4. Investing isn't about intellect or money

Contrary to popular belief, making money in the stock market isn’t linked to intelligence. If it did, the richest people in the world would be university professors and scientists.

Investing isn’t linked to wealth either, there are plenty of multi-millionaire athletes who went bankrupt in retirement.

Successful money management is linked to temperament. The ability to control your emotions, whether it’s to resist the panic when a stock market crash, or resist greed when the market is going up too high too quickly, is paramount to successful investing.

In fact, if you remain humble and take an honest look at facts & statistics, you’ll find that index funds outperform the vast majority of Wall Street money manager. You’ll also find that following the crowd is a losing strategy, i.e. if the stock you’re about to buy is popular, chances are it won’t perform well over the long term.

5. Money is worth more in the future

This one blew my mind.

Let’s say you have 5,000$ sitting in your bank account. If you spend that money now you can probably afford an old used-up car. But if you invest that money in the stock market, you’ll have enough to buy a brand new luxury Porsche in 30 years.

Let’s put it another way: The latest iphone is currently priced at 1,299$. Would you rather have the latest iphone today? Or forgo a new phone for a little while, invest that 1,299$ and let it grow to 17,000$ in 30 years?

In other words: is today’s iphone worth 17,000$ to you in 30 years? If not, you better start investing.

6. Investing has incredible compounding effect

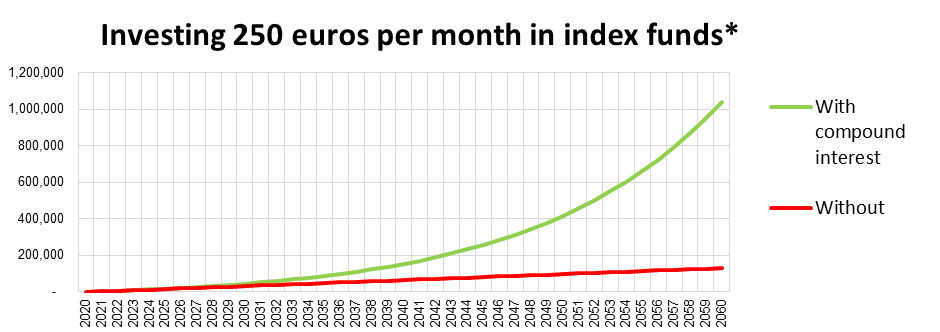

Compound interest is incredible, it’s how you can turn the 30$ in your pocket into a 1,000$ in a 40 years. If this doesn’t convince you, maybe the chart below will.

Compound interest has been described as the 8th wonder of the world. It is this little wonder that makes investing the best way to grow your money.

7. Beware of taxes

On your path to financial freedom, you’ll discover what we call passive income. Passive income is great: it allows you to make money in your sleep!

Passive income is a wonderful thing, but don’t be too quick to chase after it right now. You see, each time you receive income, whether its from interests on your savings account or dividends from the great dividend stocks you’ve bought, you’re going to get taxed.

While there’s nothing wrong with paying taxes on your profits, there is no reason to pay taxes right now if you don’t have to. Luckily for us we have these wonderful things called index funds and ETFs. Most index funds will automatically re-invests your dividends for you, which means you’re not going to be taxed each time you receive them. This allows you to reduce taxes and thus increase returns.

8. Index funds significantly reduce risk

Buying an index fund is as easy as buying a stock. Just log-in to your brokerage account, select an index fund, and click buy.

But contrary to stocks, index funds carry significantly lower risk than an individual stock. You see, an individual stock can always go bankrupt (thus you’ll lose all your money invested in that stock) but when you buy an index fund you’re not buying just one company, you’re buying hundreds of stocks at the same time.

This means index funds are an amazing way to diversify. I myself am diversified across over 6400 stocks with just 6 index funds ETF. Now, what are the odds that 6400 global companies all go bankrupt at the same time?

9. Asset allocation can reduce risk and increase returns

Now if you’ve gotten this far down the article, this probably isn’t the first time you’re reading into investing, so you probably must know that higher returns must mean higher risk right?

What if I told you this wasn’t the case?

Academics have ran the number and found that a strategic asset allocation can minimize risk while maximizing returns.

And don’t worry, as per point #4, you don’t need a Swiss banker or superior intellect to pull off this strategy, all you need is a cool head and a little discipline.

10. Index funds outperform every investor, including you

This one took me a while to learn. As was the case with most of us, I naively thought that by following stock market news and applying the stock picking strategies and guidelines highlighted in famous investment books, I could beat the market.

But I didn’t.

Beating the market consistently is not only difficult, it is near impossible. Studies have found that over 65% of stocks underperform their index in a given year. This means that to beat the market isn’t a 50/50 chance, it’s a 35/65 probability.

Sure, beating the market once is feasible, hell you’ve got a 35% chance of doing it if you pick stocks at random!

But to do it two years in a row? You’d need to get lucky twice. This means your probability of beating the market two years in a row in 12.25%

Beating the market 3 years in a row? That’s a 4.2% probability. 4 years in a row? 1.5% probability. I think you know where I’m going with this but here goes anyway: the odds of beating the market 10 years in a row is 0.002%. At this point you’re better off playing the lottery.

There’s a reason Jack Bogle is famously quoted with the following:

“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.“

Bottom line: Beating the market is next to impossible. The best thing you can do is to capture the market’s gain with index funds!